Introduction: Institutional-Grade Momentum Screening Now Covers Russell 3000

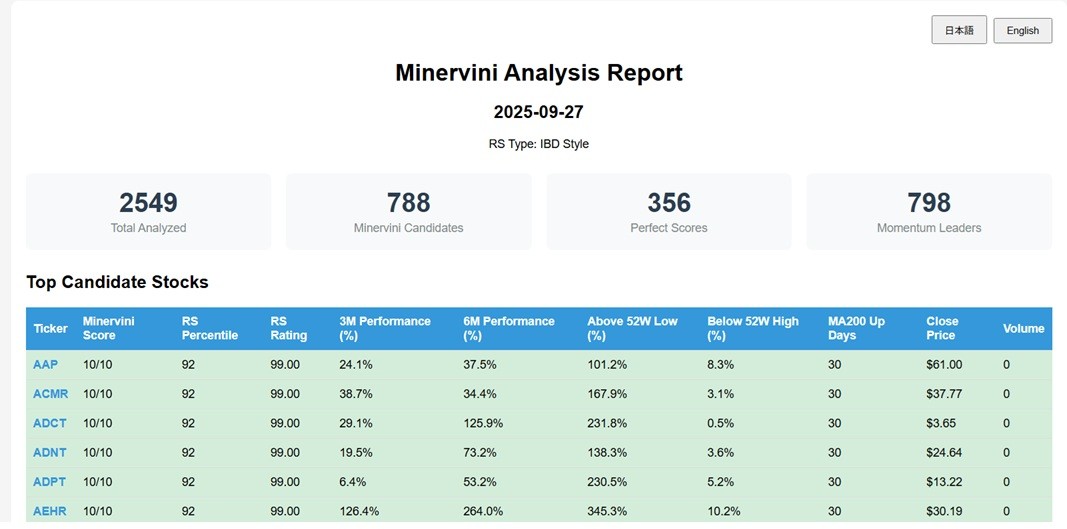

AlpharvestPro’s enhanced weekly analysis report now provides comprehensive coverage of 2,549 US stocks including the entire Russell 3000 index, utilizing Mark Minervini’s proven investment methodology with IBD-style RS calculations. Today, we’ll show you how to maximize this expanded report to efficiently discover the strongest momentum stocks across the broader US market.

📊 Enhanced Minervini Report Structure & Elite Stock Discovery

Expanded Coverage Dashboard

Enhanced Minervini Analysis – 2025-09-27

Our scaled-up report now displays four powerful metrics:

- 2,549 Total Stocks Analyzed: Complete Russell 3000 coverage

- 788 Minervini Candidates: Stocks meeting strict momentum criteria

- 356 Perfect Score Stocks: Elite performers scoring 10/10

- 798 Momentum Leaders: Stocks showing exceptional strength

This represents a 67% increase in coverage from our previous 1,526 stock universe, providing deeper market breadth analysis.

🎯 Finding Elite Momentum Stocks: The Professional Approach

- Premium Stock Criteria (Ultra-Elite Momentum)

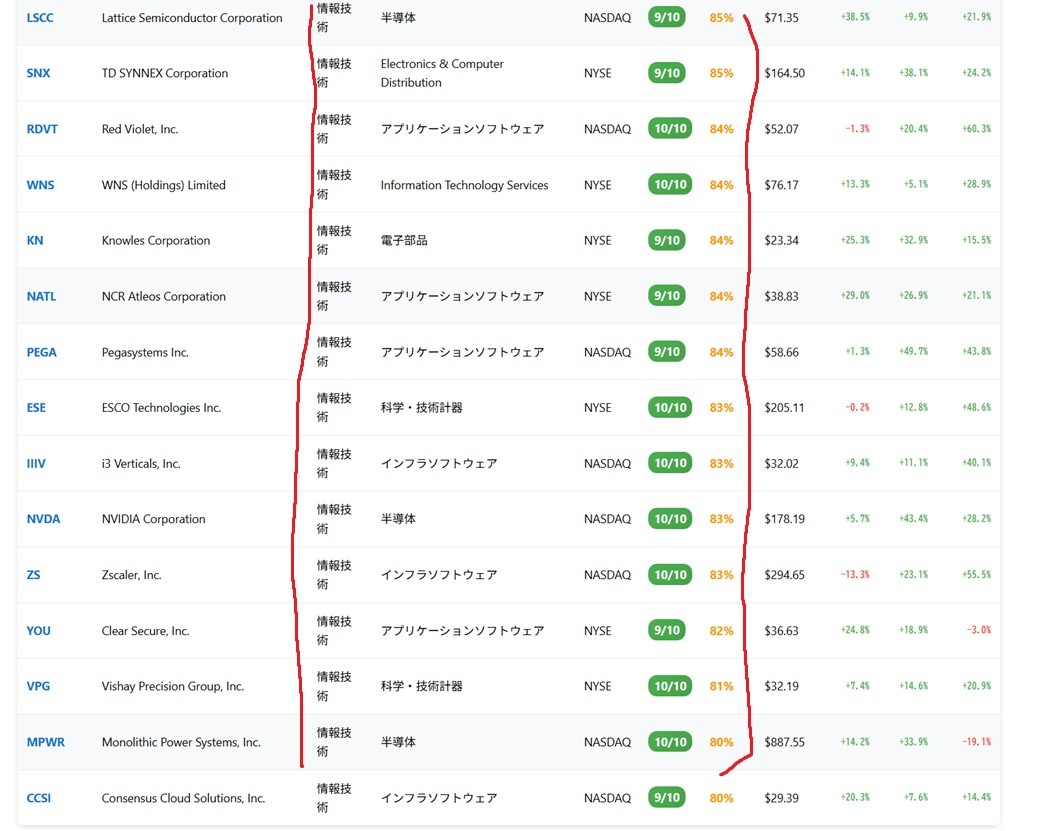

RS 90%+ combined with Minervini Score 10/10 identifies the market’s strongest momentum leaders.

How to Navigate the Enhanced Report:

- Use the Min Score dropdown to filter for “10” (perfect scores)

- Check RS Rank column for 85%+ values (top 15% of market)

- Review Sector filter to focus on leading industries

- Toggle between 日本語/English for bilingual analysis

Elite Examples from Latest Report:

- AAP (Advance Auto Parts): Score 10/10, RS 92%, +24.1% (3M), +37.5% (6M)

- ACMR (ACM Research): Score 10/10, RS 92%, +38.7% (3M), Technology sector

- ADCT (ADC Therapeutics): Score 10/10, RS 92%, +29.1% (3M), Healthcare/Biotech

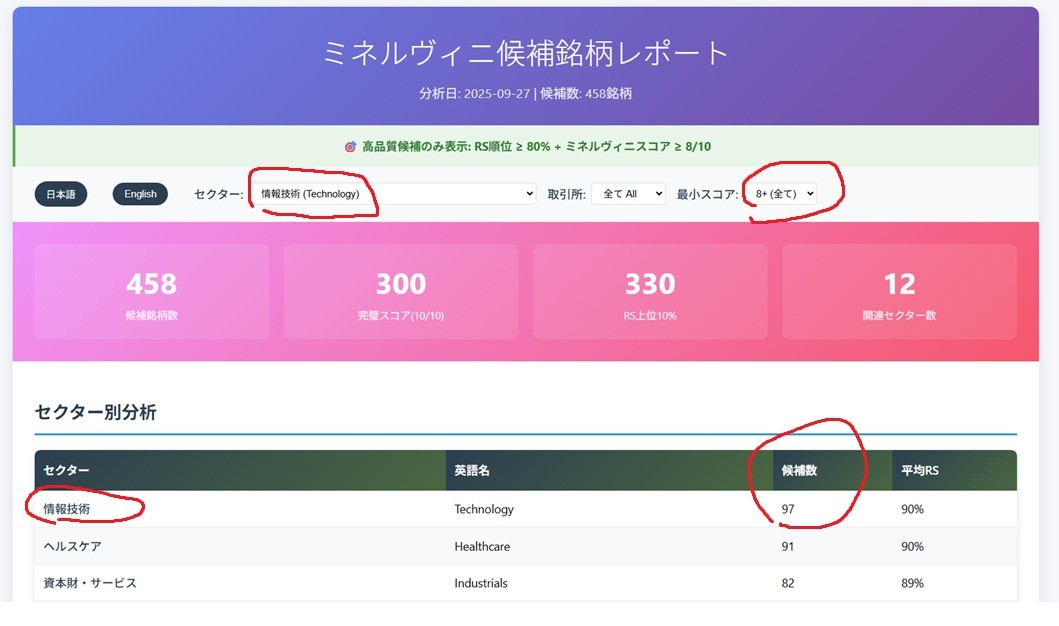

- Sector Leadership Analysis (12 Sectors Represented)

Leading Sectors by Average RS:

- Technology: 97 candidates, 90% avg RS – Clear market leadership

- Healthcare: 91 candidates, 90% avg RS – Biotech strength

- Basic Materials: 21 candidates, 91% avg RS – Commodity momentum

- Communication Services: 23 candidates, 89% avg RS – Digital transformation

Sector Rotation Insight: Technology and Healthcare dominating with 90% average RS indicates risk-on momentum favoring growth sectors.

💻 Advanced Report Features & Navigation

Triple-Filter System

The enhanced report provides three powerful filtering options:

- Sector Filter (セクター)

- Choose from 12 major sectors

- Compare within-sector performers

- Identify sector rotation patterns

- Exchange Filter (取引所)

- NASDAQ: Growth & Tech focus

- NYSE: Large-cap & established companies

- Filter by listing venue for targeted analysis

- Min Score Filter (最小スコア)

- Set to “10” for perfect scores only

- “8” for high-quality candidates

- Quickly narrow down to elite stocks

Performance Metrics Columns

- 3M Perf: Short-term momentum indicator

- 6M Perf: Medium-term trend confirmation

- 12M Perf: Long-term strength validation

- RS Rank: Percentile ranking vs. entire universe

🔍 Professional Screening Workflow

Step 1: Elite Filtering

- Set Min Score to “10”

- Sort by RS Rank (highest first)

- Note stocks with RS 85%+

Step 2: Sector Focus

- Select leading sectors (Technology, Healthcare)

- Compare multiple stocks within the same industry

- Identify sector-wide momentum themes

Step 3: Chart Verification

- English View: Click ticker for Finviz weekly charts

- Japanese View: Click ticker for Kabutan analysis

- Confirm volume patterns and breakout setups

Step 4: Performance Analysis

- Look for accelerating returns: 3M > 6M performance

- Avoid decelerating momentum: 3M < 6M performance

- Focus on consistent positive performance across timeframes

📈 Key Improvements in the Expanded Report

Coverage Enhancement

- 67% more stocks analyzed (2,549 vs 1,526)

- Russell 3000 inclusion captures small & mid-cap opportunities

- Deeper sector representation with 12 sectors covered

Quality Metrics

- 458 high-quality candidates meeting baseline criteria

- 300 perfect scores (10/10) – exceptional depth

- 330 stocks in top 10% RS ranking

IBD-Style RS Calculation

The report explicitly shows “RS Type: IBD Style” confirming institutional-grade relative strength methodology.

⚠️ Risk Management with Expanded Universe

Position Sizing Considerations

- With more candidates, maintain disciplined position sizing

- Maximum 20% per position regardless of opportunities

- 7-8% stop-loss remains critical

Quality Over Quantity

- More candidates doesn’t mean more positions

- Focus on top RS performers (85%+) with perfect scores

- Sector diversification becomes more important

🎯 Professional Trading Edge

This expanded report provides institutional-level market intelligence:

- Elite Momentum (RS 90%+ × Score 10/10):

- Immediate watchlist additions

- Example: Technology sector showing 97 candidates with 90% avg RS

- Rising Stars (RS 80-89% × Score 10/10):

- Tomorrow’s leaders emerging

- Monitor for breakout setups

- Sector Intelligence:

- 12 sectors tracked for rotation patterns

- Technology/Healthcare leadership confirms growth regime

- Broad Market Breadth:

- 788 candidates from 2,549 stocks (31% pass rate)

- Healthy market participation

💡 Pro Tips for the Enhanced Report

Bilingual Advantage

- Toggle between 日本語/English for different perspectives

- Japanese view links to Kabutan for Asian trading hours insight

- English view connects to Finviz for technical analysis

Filtering Combinations

- Momentum Leaders: Score 10 + RS 85%+ + Technology sector

- Value Momentum: Score 10 + RS 80-85% + Financial sector

- Biotech Rockets: Score 10 + Healthcare + NASDAQ

Weekly Review Process

Every Saturday when the report updates:

- Review sector changes week-over-week

- Track RS rank improvements/deterioration

- Note new entries to perfect score list

- Monitor sector rotation patterns

Summary: Your Competitive Edge

The expanded AlpharvestPro Minervini report covering 2,549 stocks provides:

- 3x more perfect score candidates (356 vs previous ~150)

- Complete Russell 3000 coverage for broader opportunities

- 12 sector analysis for rotation insights

- IBD-style RS rankings for institutional-grade analysis

By consistently reviewing this comprehensive weekly report, you’ll identify market shifts early, discover hidden gems in the expanded universe, and capture significant profit opportunities across all market capitalizations.